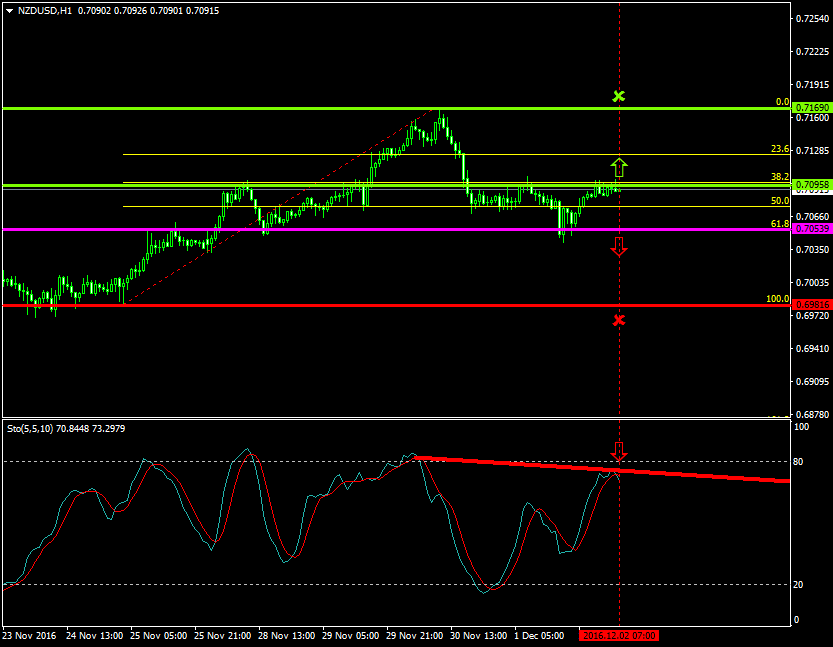

Will the sellers place pressures on the NZDUSD at 0.7053?

The pair has been lately oscillating between the range of 0.7169 and 0.7053 as the bears were able to make good gains within such a channel formation

On the other hand, the buyers attempted to place greater pressures, since the 1st of December 2016, and managed to force the pair from 0.7053 to as low as 0.7095.

Probable Scenario

The latest stabilization of the price close to the 0.7053 area is a good indication that the pair may resume to the downside.

In the condition where the pair drops, the bears could lock their profit at 0.6981, Fibonacci’s 100.0%.

The Stochastic oscillator confirms the downtrend condition showing that the price has greater chances of retracing lower at the 75 level.

Alternative Scenario

In contrast, in the scenario where the buyers place far greater pressures and the price rises above the 0.7095 zone, the pair could appreciate to 0.7169.

Today’s Major Announcements

- There are no any releases that could have a major impact on the New Zealand dollar

- U.S.’s Unemployment Rate (Nov), the Labor Force Participation Rate (Nov), and the Nonfarm payrolls (Nov) announcements could have a strong impact on the U.S. dollar

Synopsis

· Probable trend (Bearish): 0.7053

· Bearish take profit target: 0.6981

· Stop loss target: 0.7095

· Alternative trend (Bullish): 0.7095

· Bullish take profit target: 0.7169