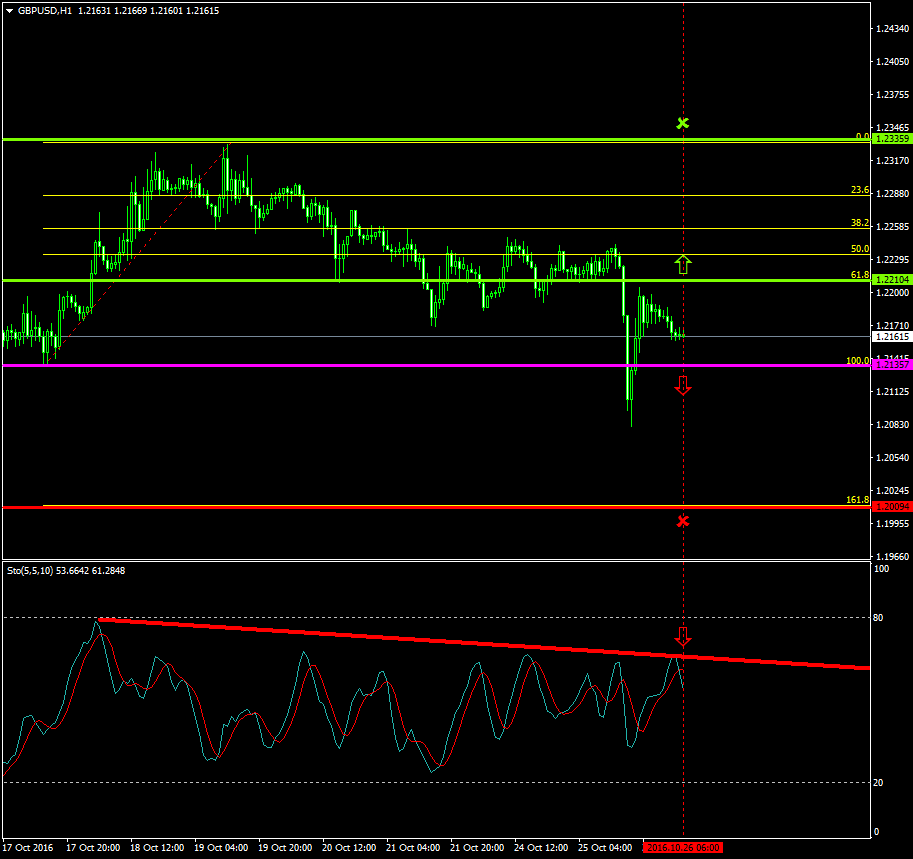

Is 1.2135 sellers’ opportunity on the GBPUSD?

The GBPUSD has been mostly oscillating, since the 19th of October 2016, within a bearish formation between 1.2335 and 1.2135 respectively.

Both the buyers and the sellers are now placing pressures in their attempts of taking control over the pair.

The price is now oscillating slightly above the 1.2135 zone which is today’s major pivot point area.

Probable Scenario

In the condition where the pair stabilizes below the 1.2135 zone, the price could be forced to decline to lower areas such as the 1.2009 level.

The Stochastic oscillator also confirms that the price has greater chances to retrace and decline at the 60 level.

Alternative Scenario

Alternatively, should the buyers take the lead, boost, and hold the price above the 1.2210 area, Fibonacci’s 61.8%, the pair could appreciate as high as 1.2335.

Today’s Major Announcements

- There are no any releases on the sterling

- The Goods Trade Balance (Sep), the Markit PMI Composite (Oct), the Markit Services PMI (Oct), the New Home Sales (MoM) (Sep), and the New Home Sales Change (MoM) (Sep) releases are expected to have a medium influence on the U.S. dollar

Synopsis

· Probable trend (Bearish): 1.2135

· Bearish take profit target: 1.2009

· Stop loss target: 1.2210

· Alternative trend (Bullish): 1.2210

· Bullish take profit target: 1.2335