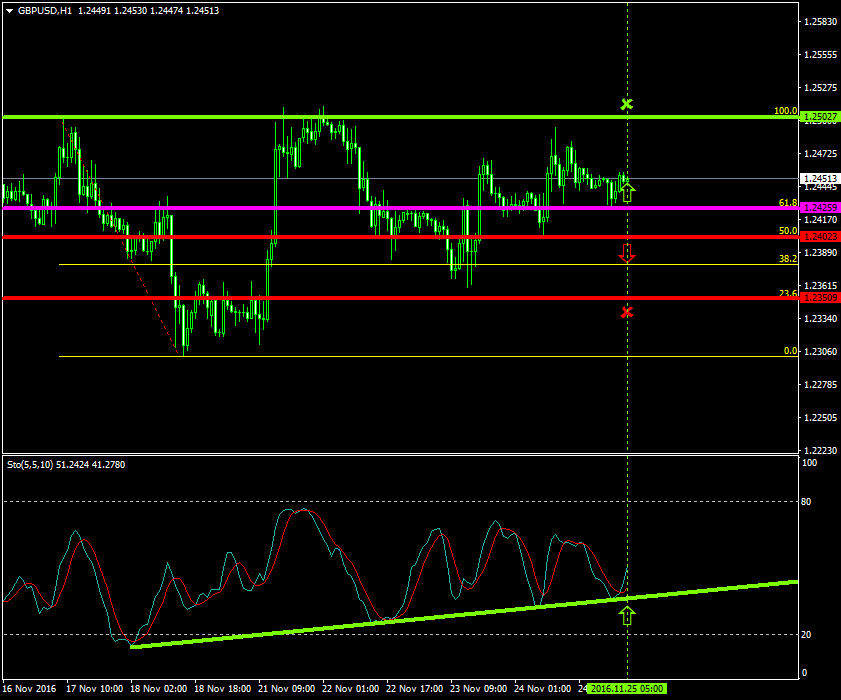

Will the buyers lead the GBPUSD at 1.2425?

The GBPUSD after rising from 1.2350 to 1.2502 has now stabilized slightly above today’s major pivot point area, the 1.2425 zone.

Stochastic oscillator’s formation shows a pattern of a steady rise at the 40 level where the pair is expected to retrace to the upside.

Probable Scenario

In the condition where the pair stabilizes above the 1.2425 level and the bullish pressures get more tensed, the price could appreciate to the 1.2502 zone.

Should the buyers gain control, then such a continuation confirms their profitable upside attempts since the 18th of November 2016.

Alternative Scenario

Alternatively, in the event where the bearish pressures force the pair below the 1.2402 zone, the price could drop to 1.2350.

Today’s Major Announcements

- The Gross Domestic Product (QoQ) (Q3) release is expected to have a strong impact on the sterling

- The Markit Services PMI (Nov) and the Markit PMI Composite (Nov) releases will likely have a medium influence on the U.S. dollar

Synopsis

· Probable trend (Bullish): 1.2425

· Bullish take profit target: 1.2502

· Stop loss target: 1.2402

· Alternative trend (Bearish): 1.2402

· Bearish take profit target: 1.2350