It might not be the first material that comes to mind when you think about investment opportunities. However, graphite is a mineral with several desirable properties and characteristics, making it an attractive option for investors to add some exposure to the mining sector. In this guide, we will look at what graphite is, why it might be worth investing in, and how you can do so. We will also explore some of the critical risks of investing in graphite miners and producers. So, if you’re interested in learning more about this exciting commodity, keep reading!

Also read: Why You Need To Do a Tenant Background Check.

1. What Is Graphite, And Why Might It Be Worth Investing In?

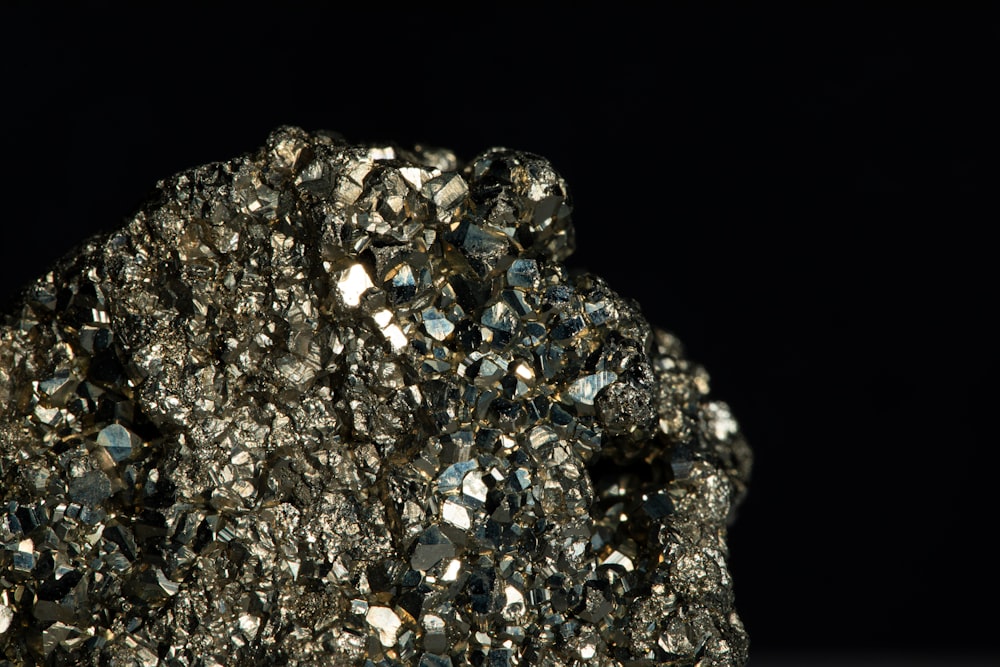

Graphite is a naturally-occurring form of carbon. It is exceptionally soft and lustrous, and manufacturers have used it in pencils and other writing implements for centuries. In recent years, graphite has become an important industrial material, as industries use it in batteries, steelmaking, brake pads, and other applications, thus increasing graphite demand.

As graphite is a non-renewable resource, there is a risk that supply will not keep up with graphite demand in the future. This could lead to higher prices for graphite stocks, mostly the high-quality graphite concentrate, making it an attractive investment opportunity.

Another reason to invest in graphite is the growing demand for electric vehicles. As battery technology improves, electric cars are becoming increasingly popular, likely to drive up demand for graphite. With these factors in mind, investing in graphite-like spherical graphite could be a wise move.

Also read: 5 Up and Coming Economies that Are Growing Faster than Expected

2. How To Invest In Graphite

Graphite is a naturally-occurring form of carbon that is usable in various industrial and commercial applications. Unlike other forms of carbon, such as coal and Diamond, graphite is an excellent conductor of heat and electricity.

One way to mitigate the risk of investing in graphite is to invest in companies that have diversified operations. For example, some mining companies also produce other minerals, such as copper or zinc. This diversification can help insulate the company from fluctuations in the price of any one commodity.

In addition, it is essential to research the management team of any company before investing. A company’s success depends mainly on the experience and competence of its leadership. It is possible to profit from the graphite market while minimizing risk after the first graphite deposits by carefully selecting investments.

Also read: The Cannabis and Hemp Markets in 2020

3. Risks Associated With Investing In Graphite Miners And Producers

Graphite is a critical material that industries use in lithium-ion battery anodes. The global demand for graphite will increase significantly in the coming years. As a result, many investors have shown interest in graphite mining stocks and production companies. However, there are several risks one can associate with this industry.

Graphite prices are highly volatile, and investors could lose a significant amount of money if prices drop suddenly.

The graphite mines and production industry are highly competitive, and companies that don’t have a competitive advantage could quickly fall behind.

Political instability in mined graphite countries could lead to supply disruptions and further price volatility. As a result, investors should be aware of these risks before investing in graphite mining and production companies.

As mentioned earlier, most of the world’s graphite reserves are located in China. This concentration of supply presents a risk to investors, as the Chinese government could withhold supplies to drive up prices.

The graphite mining and production industry is highly competitive, and companies that don’t have a competitive advantage could quickly fall behind.

As a result, investors should be aware of these risks before investing in graphite miners and producers, but they need to do a graphite exploration first.

Also read: What to Keep in Mind When Choosing an Enterprise eCommerce Platform.

What Are The Benefits Of Investing In Graphite Miners And Producers?

Graphite is a critical raw material applicable in various industries, including the production of batteries, steel, and other high-tech applications. As demand for these products continues to grow, so does the need for graphite.

Unfortunately, graphite is a relatively rare mineral, and mine production has not been able to keep up with demand. As a result, graphite prices have been rising in recent years.

For investors, this presents an opportunity to profit from the growing demand for graphite. In addition, investors can gain exposure to this critical market by investing in graphite miners and producers.

Additionally, because graphite is not for trade on major exchanges, it can be difficult for investors to find ways to invest in this market. However, investors can gain access to this critical market by investing in companies involved in graphite production.

What Should I Look For When Researching Graphite Companies?

Graphite is a carbon-based material with a wide range of applications in industry, from conducting electricity to lubricating industrial machinery. As a result, it is an essential ingredient in various products, ranging from batteries to steel. As such, graphite is a valuable commodity, and many companies are vying for a piece of the pie. So, what should you look for when researching graphite companies?

First and foremost, you’ll want to consider the company’s production capacity. Companies mine graphite and process it into finished products, so a company’s production capacity will give you an idea of how much graphite they can produce. You’ll also want to look at the company’s customer base. Some companies specialize in particular industries, while others sell their products to a more diverse customer base.

This will give you an idea of where the company’s products are being used and how stable their demand is. Finally, you’ll want to look at the company’s financials. This will give you an idea of their profitability and help you assess their long-term prospects. By taking all of these factors into consideration, you’ll better understand which graphite companies are worth investing in.

Also read: What Are the Top Industries in Israel?

Frequently Asked Questions

How Is Graphite Used?

Graphite can be used in various applications, including batteries, lubricants, and brake pads.

Where Is Graphite Found?

Most of the world’s graphite reserves are located in China.

How Can I Invest In Graphite?

One way to invest in graphite is to invest in companies with diversified operations. For example, some mining companies also produce other minerals, such as copper or zinc. This diversification can help insulate the company from fluctuations in the price of any one commodity.

The Bottom Line

Graphite is a critical material used in various industrial and commercial applications. As a result, the demand for graphite is expected to increase significantly in the coming years. However, several risks are associated with investing in graphite miners and producers, such as price volatility, competition, and political instability. As a result, investors should be aware of these risks before investing in this industry.