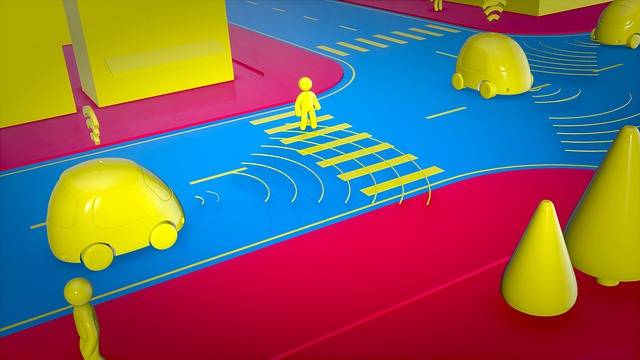

Investors are always looking for the next big thing, and many believe Waymo stock is it. The company has been making waves in the self-driving car industry, and its stock is expected to soar. You need to know if you’re thinking about investing in Waymo stock. First, let’s take a look at what makes Waymo so unique. Then we’ll discuss how to invest in the company’s stock. Finally, we’ll give you some tips on making sure your investment pays off. So read on to learn more about Waymo and how to invest in Waymo stock!

Also read: UK GDP Slumps to 6-Month Low

What Is Waymo Stock, And Why Should You Invest In It

Waymo is an autonomous vehicles technology company created by Google’s parent company in 2009. The company’s goal is to make self-driving cars a reality, and it has been working towards this goal by developing its own self-driving cars software and hardware. Waymo has raised over $3 billion from investors, and its current valuation is around $30 billion.

So why should you invest in Waymo stock? There are a few reasons. First, the company is at the forefront of autonomous driving technology. This rapidly growing industry is expected to be worth billions of dollars in the next few years. Second, Waymo has partnerships with some of the biggest names in the auto industry, including Fiat Chrysler, Jaguar, and Lyft.

These partnerships give the company access to a large potential market for its products. Finally, Waymo has a strong leadership team with experience in the tech and automotive industries. This combination of factors makes Waymo an attractive investment opportunity.

How To Buy Waymo Stock

When it comes to investing in driverless car technology, Waymo is one of the most well-known companies. While the company is yet to trade publicly, that doesn’t mean that it’s impossible to invest. Here’s a step-by-step guide on how to buy the Waymo stock ticker.

First, you’ll need to set up an account with a broker that offers private company shares, such as EquityZen or SharesPost. Once you’ve done that, you’ll be able to search for Waymo and request an allocation of shares. Then, depending on the broker, you may be able to buy shares directly from Waymo or from another investor who is looking to sell.

Once you’ve found a seller and agreed on a price, the shares will be transferred to your brokerage account. You’ll be able to own and trade them just like any other stock. However, it’s essential to keep in mind that because Waymo is a private company and not a publicly-traded company, there will be fewer buyers and sellers in the market, making it more difficult to find a buyer when you’re ready to sell.

Investing in private companies comes with higher risks, such as crashes that involve human error, than investing in public companies. However, for those willing to take on that risk, investing in Waymo could be a way to profit from the driverless car revolution.

Also read: Nonfarm Payrolls Disappoint to Add to US Woes

What Are The Risks And Benefits Of Investing In Waymo Stock?

Investing in any company comes with a certain amount of risk. When it comes to investing in Waymo, there are a few key risks to be aware of. First and foremost, as Waymo is still a relatively new company, it is not yet profitable. This means that there is a higher risk that the company will not be able to generate enough revenue to sustain itself in the long term. In addition, Waymo is also facing stiff competition from other companies working on self-driving vehicles, such as Uber and Tesla. As a result, there is a risk that Waymo will not be able to maintain its current lead in the self-driving industry.

Despite these risks, several reasons why investing in Waymo could be a good idea. First, self-driving technology will proliferate in the coming years, thus producing fully autonomous vehicles, and Waymo is currently the clear leader. This means that there is a good chance that the company will find success as the self-driving vehicles industry expands. In addition, Waymo is already starting to generate revenue with a Waymo driver through its partnerships with ride-hailing companies like Lyft and Uber. As it continues to forge these partnerships, there is a good chance that its revenue will grow.

Overall, investing in Waymo is a risky but potentially rewarding proposition. Self-driving technology is still in its early stages, but Waymo appears well-positioned to succeed in this rapidly growing industry. However, it is essential to remember that the self-driving technology company is still unprofitable and faces stiff competition.

Also read: Crypto Deposit Solution LegionPay Relaunches as a Multi-service Payment Service Provider

Conclusion

So, if you’re interested in investing in Waymo stock, it’s not as difficult as you might think. You’ll just need to set up an account with a broker that offers private shares and then search for Waymo. From there, you can request an allocation of shares and buy them directly from the company or another investor. Just be sure to keep in mind that these are still very early days for this technology, so there is always some risk involved.