What’s next on the USDCHF pair, bearish at 0.9858?

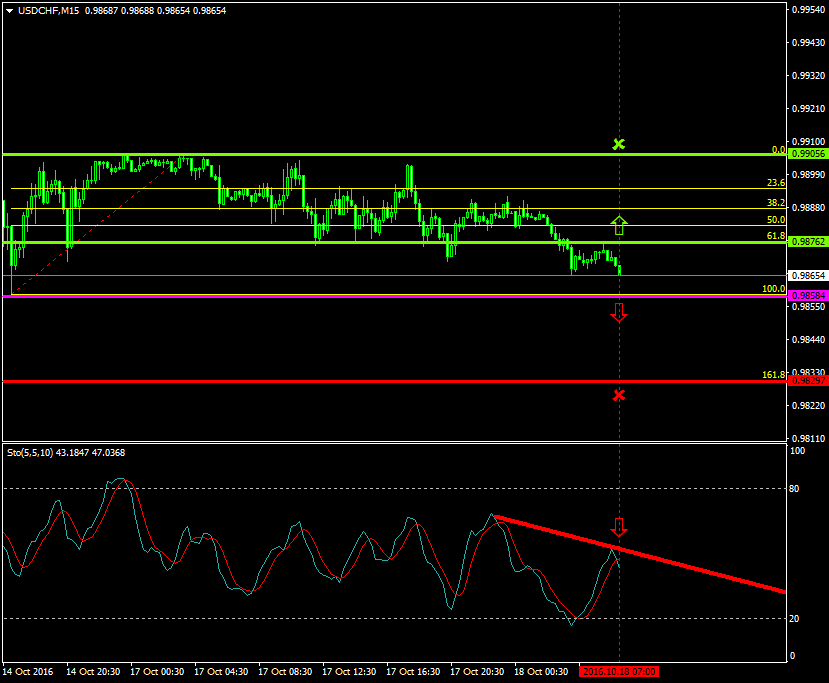

The USDCHF pair has been, since the 17th of October 2016, oscillating within a downside formation between the range of 0.9905 and 0.9858 respectively.

Will the bears take control over the price or do the buyers have something else in mind?

Today’s major pivot point area is the 0.9858 level where the sellers will likely take their chances to shift the price to their favour.

Probable Scenario

The latest stabilization of the pair close to the 0.9858 level is a good indication that the sellers may exert greater pressures to force the price to the downside.

The Stochastic oscillator has also confirmed that the price could aggressively drop at the 50 zone.

In the scenario where the pair decelerates, the price could fall to 0.9829 Fibonacci’s 161.8%.

Alternative Scenario

Alternatively, in the event where the sellers are not able to hold the price below the 0.9876 level, and the buyers place greater pressures, the pair could rise to 0.9905.

Today’s Major Announcements

- The Consumer Price Index Core s.a. (Sep), the Consumer Price Index n.s.a (MoM) (Sep), the Consumer Price Index (MoM) (Sep), the Consumer Price Index Ex Food & Energy (MoM) (Sep), the Consumer Price Index Ex Food & Energy (YoY) (Sep), the Consumer Price Index (YoY) (Sep), and the NAHB Housing Market Index (Oct) releases are expected to have a medium influence on the U.S. dollar

- There are no any major announcements that could strongly impact the Swiss franc

Synopsis

· Probable trend (Bearish): 0.9858

· Bearish take profit target: 0.9829

· Stop loss target: 0.9876

· Alternative trend (Bullish): 0.9876

· Bullish take profit target: 0.9905